Introduction to Cryptocurrency Adoption

Cryptocurrency is rapidly changing the landscape of global financial transactions. While many countries are still hesitant to embrace cryptocurrencies fully, some have started accepting them for daily transactions. This article explores the countries at the forefront of this digital finance revolution, detailing how they’re integrating cryptocurrencies into everyday life.

El Salvador: A Pioneer in Cryptocurrency Adoption

El Salvador made global headlines in September 2021 when it became the first country to accept Bitcoin as legal tender. This initiative, led by President Nayib Bukele, aims to foster financial inclusion and attract investments in the country. Businesses in El Salvador are now legally required to accept Bitcoin in addition to the US dollar, which remains the primary currency. This integration provides an opportunity to analyze the effects on the economic landscape, including the potential changes in consumer behavior and the level of comfort with digital currencies in a traditionally cash-based economy.

Moreover, the move to legalize Bitcoin has been bolstered by the establishment of dedicated Bitcoin ATMs and the enhancement of digital infrastructure to support cryptocurrency transactions throughout the nation. The country hopes to not only deepen financial inclusion for the unbanked population but also to attract foreign investors and tech companies seeking a crypto-friendly environment.

Switzerland: A Crypto-Friendly Haven

Switzerland, renowned for its stable banking ecosystem, has embraced cryptocurrencies as part of its effort to maintain its reputation as an innovation hub. The city of Zug, often referred to as Crypto Valley, allows its residents to pay for certain public services using Bitcoin. This initiative enhances the appeal of the region for numerous blockchain startups, thus stimulating economic activity and fostering a thriving technology sector.

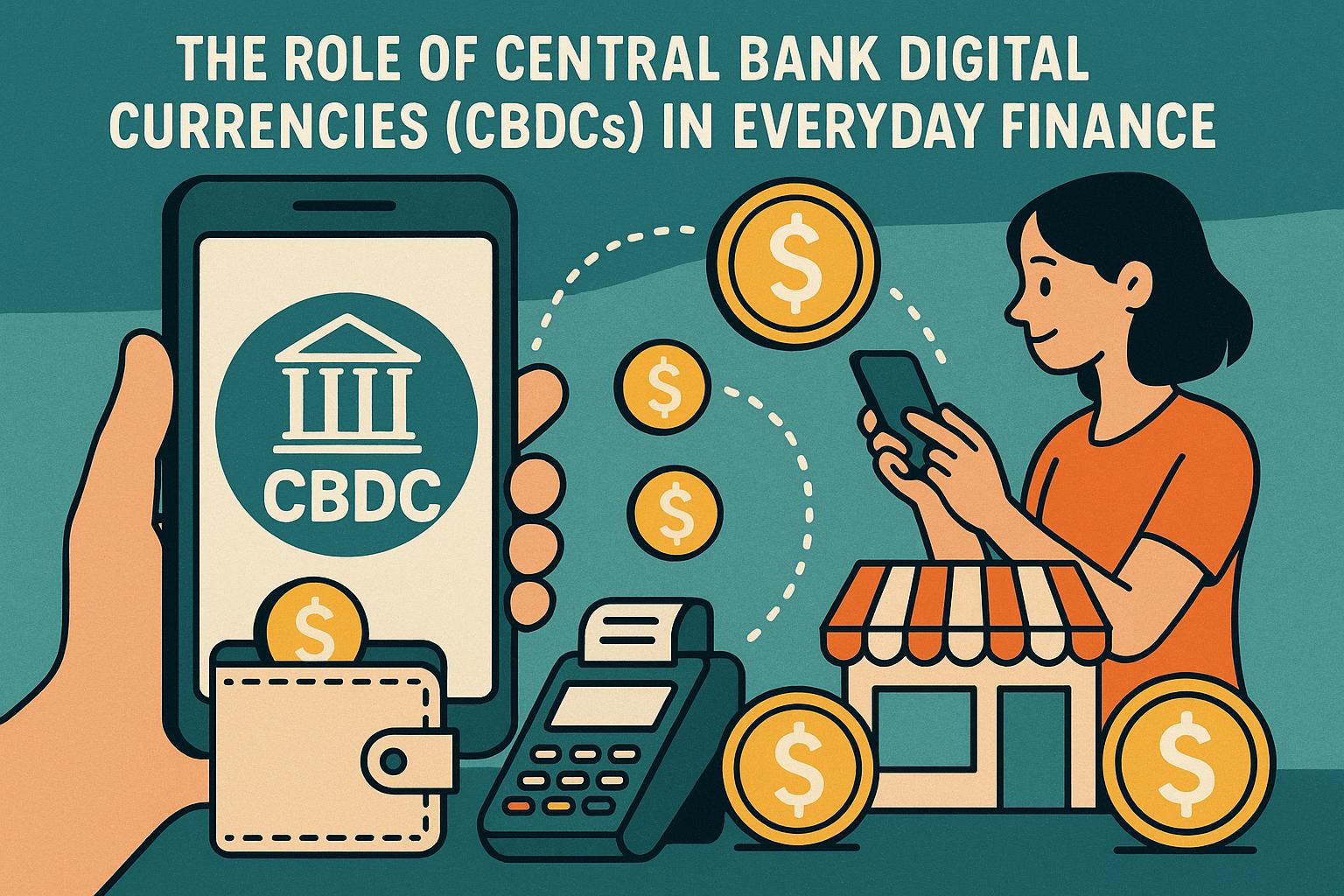

Cryptocurrency Tax Payments

In addition to day-to-day transactions, certain Swiss cantons permit citizens to pay taxes using cryptocurrencies. This regulatory environment continues to make Switzerland an attractive destination for crypto enthusiasts and entrepreneurs. Moreover, Switzerland’s comprehensive regulatory framework, which includes precise guidelines for Initial Coin Offerings (ICOs) and cryptocurrency exchanges, plays a vital role in providing security and stability in the increasingly volatile cryptocurrency market.

The acceptance and integration of cryptocurrencies in Switzerland are not limited to governmental frameworks; they extend to various sectors, including finance, insurance, and retail, each experimenting with fluctuating degrees of digital currency adoption.

Portugal: A Growing Interest in Digital Currency

Portugal’s warm stance on cryptocurrency is evidenced by its tax-free policy on cryptocurrencies for individual investors. While it does not officially recognize cryptocurrencies as legal tender, businesses, particularly in the tech and hospitality industries, are increasingly accepting them in daily operations. This shift is largely driven by Portugal’s growing expat community and tech ecosystem.

Tourism Sector Adoption

Notably, cryptocurrency payments in Portugal are gaining traction in the tourism sector, where hotels and restaurants are beginning to offer this payment option to tech-savvy travelers. This move not only caters to the demands of a tech-forward clientele but also aligns with global trends that favor modern payment methods. As the tourism industry continues to adapt, there is significant potential for cryptocurrency to reduce transaction fees and increase efficiency in cross-border payments, offering a seamless experience to international tourists.

Portugal’s leniency towards individual cryptocurrency gains, coupled with the burgeoning tech industry, also encourages an enterprising environment for digital nomads and startups keen on leveraging blockchain and cryptocurrency technologies.

Japan: Integrating Cryptocurrency into Daily Life

Japan has long been a leader in technology and innovation, and this extends to its approach to cryptocurrency. Since 2017, Bitcoin has been recognized as a legal form of payment. Various retail companies, including major electronics retailers, offer cryptocurrency payment options, reflecting Japan’s growing comfort with digital currencies. This level of integration not only promotes widespread adoption among tech-savvy consumers but also sets a precedent for other nations considering similar approaches.

Regulatory Framework

Japan’s Financial Services Agency (FSA) plays a crucial role in regulating and overseeing cryptocurrency exchanges, ensuring consumer protection and maintaining financial stability. As a result, Japan boasts a robust regulatory framework that supports cryptocurrency usage. This framework is particularly significant because it provides clear guidelines for businesses and consumers engaging with cryptocurrencies, thus fostering trust and confidence in the system.

By facilitating a secure environment, Japan encourages innovation and commercial activity in the cryptocurrency sector. Additionally, the country’s proactive stance on digital currencies underscores the importance of regulatory measures in mitigating risks associated with volatility and fraudulent activities that might otherwise deter adoption.

Conclusion

The global acceptance of cryptocurrency for daily transactions is on the rise, albeit at differing paces across countries. Nations like El Salvador, Switzerland, Portugal, and Japan are paving the way, showcasing varying degrees of integration and regulatory approaches. As digital currencies continue to evolve, their place in the global economy becomes increasingly significant. Each of these examples highlights the diverse strategies countries can pursue when integrating cryptocurrencies, balancing innovation with regulation to ensure financial stability and security.

Looking ahead, the potential for cryptocurrencies to reshape the global financial landscape is immense. Further exploration into how different governments and industries address challenges such as regulatory compliance, technology infrastructure, and public education will be essential in understanding the future trajectory of cryptocurrency adoption. As nations continue to navigate these challenges, the collective efforts will importantly shape the evolution of digital currencies as a cornerstone of the international financial system.

For more information on how countries are adopting cryptocurrency, visit this resource.

This article was last updated on: May 8, 2025