The Rise of Crypto Debit Cards

Crypto debit cards have emerged as a popular tool for individuals looking to integrate cryptocurrencies into their everyday financial activities. These cards allow users to spend their digital assets just like traditional currency, bridging the gap between the digital and physical economy. As the adoption of cryptocurrencies increases, the demand for reliable and versatile crypto debit cards grows as well.

Understanding How They Work

Crypto debit cards function by converting cryptocurrency into fiat currency when a purchase is made. This process ensures that merchants are paid in their preferred currency while allowing cardholders to utilize their digital assets. Typically, these cards are linked to user accounts on specific crypto exchanges or digital wallets, supporting a range of cryptocurrencies. This direct linkage enables seamless transactions and provides an easy way for users to manage their digital funds without needing to constantly convert to fiat manually.

The convenience these cards offer stems primarily from their dual ability to facilitate traditional purchases while managing digital assets efficiently. When a purchase is initiated, the card services perform real-time conversion of the user’s chosen cryptocurrency to the local fiat currency of the merchant. This feature simplifies the transaction process significantly for both parties involved, eliminating the need for specialized knowledge or systems to process digital currencies on the merchant’s end.

Key Features to Consider

When evaluating different crypto debit cards, it’s important to consider several key features that can dramatically influence the user experience and value offered by the card.

Cryptocurrency Support

The range of cryptocurrencies supported by a card can vary significantly. While some cards focus on popular coins like Bitcoin and Ethereum, others expand their offerings to include a wider array of digital currencies such as Litecoin, Ripple, and stablecoins. This versatility matters for users who hold a diverse portfolio of digital assets or wish to explore different cryptocurrencies for spending purposes. It is crucial to ensure that the card supports the specific cryptocurrencies you plan to use, as this will impact your ability to convert and spend your holdings easily.

Fees and Costs

Crypto debit cards may come with various fees, including issuance fees, annual fees, and transaction fees. Before selecting a card, users should carefully assess these potential costs, particularly those that may affect frequent spending such as point-of-sale transaction fees or currency conversion charges. Aligning the card’s fee structure with your spending habits ensures that it will be a cost-effective choice in the long term. Some cards manage to provide competitive pricing by offering fee waivers or discounts for heavy usage or holding significant amounts in their proprietary ecosystem.

Global Usability

One of the significant advantages of using crypto debit cards is their global usability. For frequent travelers, the card’s international usability is a major consideration. Some cards boast low-currency conversion fees and widespread acceptance across different countries and checkout systems. This can provide significant advantages when spending abroad, allowing cardholders to transact without worrying about excessive fees or currency-related complications. Global usability also encompasses partnerships with major payment networks like Visa or Mastercard, further broadening the acceptance of these cards.

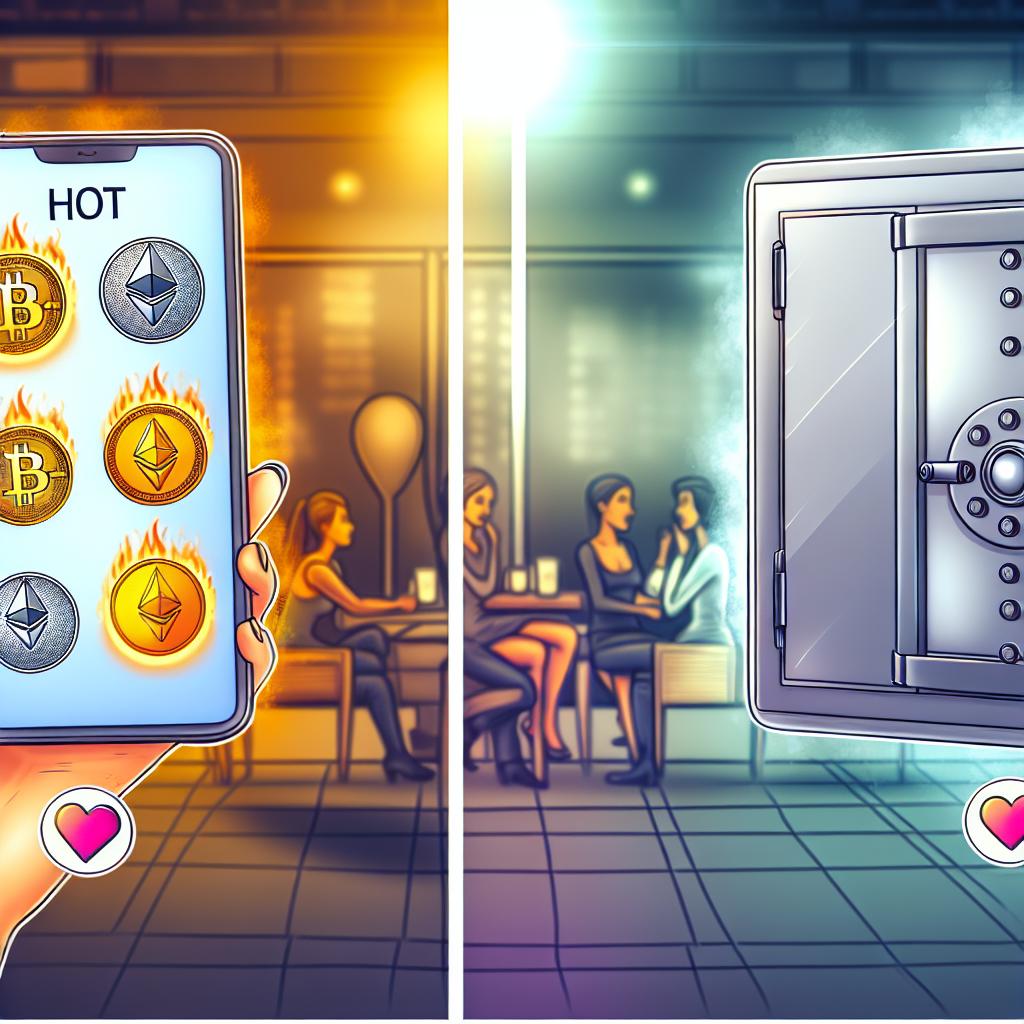

Security Features

Secure handling of digital assets is crucial as cryptocurrencies represent valuable financial holdings. Thus, robust security features in crypto debit cards become paramount in building trust with users. Key security measures include two-factor authentication to protect accounts, advanced fraud detection systems that monitor and alert users of suspicious activities, and strong encryption protocols to guard sensitive data against unauthorized access. These protections help ensure that users can manage their assets with confidence, whether they are making online purchases or tapping their card at a local store.

Popular Crypto Debit Cards

Several crypto debit cards have garnered attention for their unique features and user-friendly services. Here, we explore some noteworthy options that demonstrate what is currently available in the crypto debit card market.

Coinbase Card

The Coinbase Card offers users the ability to spend directly from their Coinbase accounts. It supports a wide range of cryptocurrencies and is known for its user-friendly interface and integrated Coinbase app management. Users benefit from easy access to their asset balances and can manage their card preferences directly within the familiar Coinbase platform, making it a practical choice for long-time Coinbase users.

Binance Card

Binance Card allows users to spend their crypto holdings with real-time conversion to fiat currency. The card supports multiple cryptocurrencies and offers competitive transaction fees, especially for Binance users who engage with the larger Binance ecosystem. By utilizing advantages such as zero transaction fees for in-network usage, this card appeals to both frequent spenders and Binance account holders looking to maximize their benefits.

Crypto.com Visa Card

The Crypto.com Visa Card is well-regarded for its extensive benefits, including cashback rewards and subscription rebates. It offers several card tiers, providing options for users with different financial goals, from basic entry-level cards to premium offerings that come with additional perks. This tiered structure empowers users to select a card that best fits their spending patterns and desired reward levels, enhancing their overall value received from everyday purchases made through the card.

Conclusion

Crypto debit cards provide a practical solution for integrating digital currencies into everyday spending. With various options available, potential users should diligently consider factors such as supported cryptocurrencies, fees, global usability, and security features. By examining these aspects, individuals can select a card that meets their financial needs and supports their lifestyle. As the crypto landscape continues to evolve, the relevance and utility of crypto debit cards are bound to expand, offering even more functionalities and seamless user experiences.

This article was last updated on: June 12, 2025